Aiming to bolster India’s GDP growth, Indian Prime Minister Narendra Modi recently announced plans to reform the country’s Goods and Services Tax ( GST ) system, which has been in place since 2017.

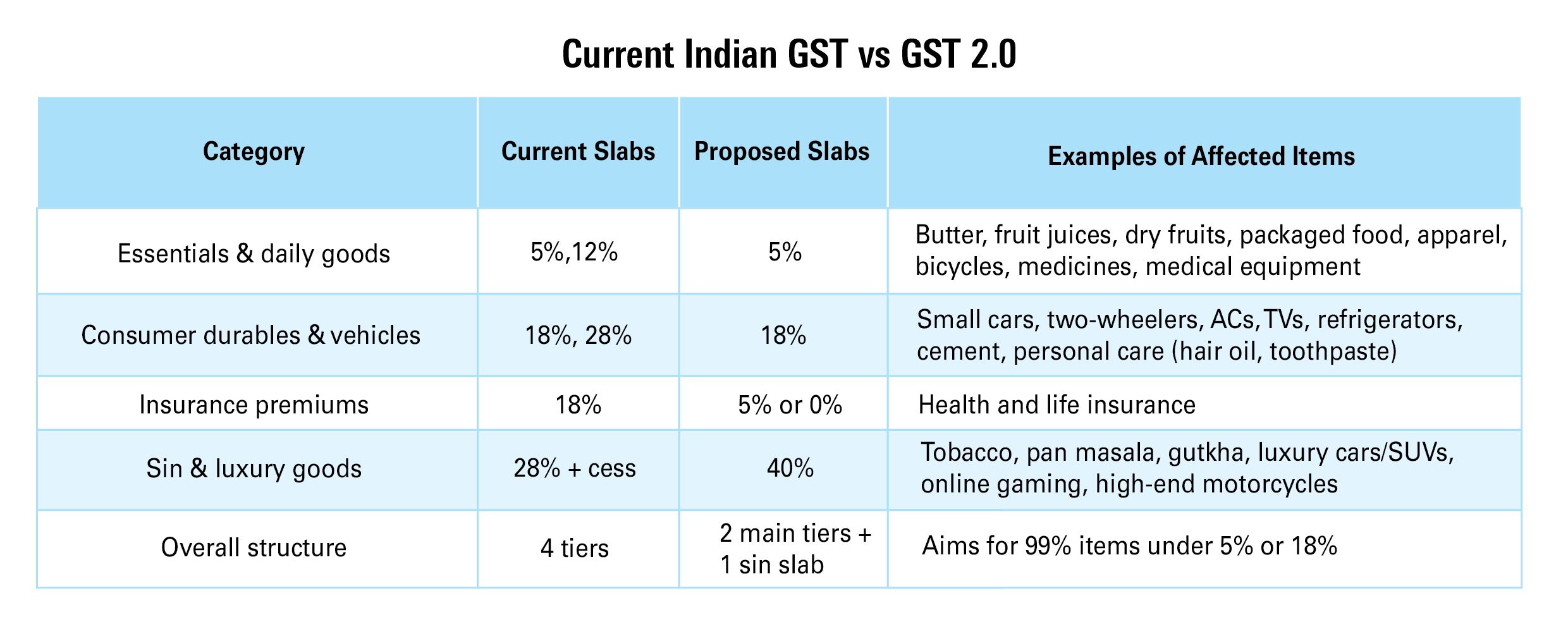

Under the proposed new measure, dubbed GST 2.0, the tax regime would further be simplified from a four-tiered system into a two-tiered system, with a 5% rate for daily necessities and an 18% rate for most other goods and services.

To counterbalance potential revenue losses to the government, a special rate of approximately 40% may apply to luxury and demerit goods, such as tobacco, aerated drinks and high-end vehicles.

Under the current four-tier system which has been in place since 2017, essential goods are taxed at 5%, intermediate goods at 12% to 18%, and luxury or demerit items at 28%.

The Modi government believes this new measure can make tax administration and compliance easier for businesses, especially micro, small and medium-sized enterprises. Lowering taxes on daily-use and aspirational goods ( for example, from 28% to 18% ) aims to reduce costs for consumers, stimulate demand and drive economic growth.

Moreover, the proposed reform seeks to maintain or enhance revenue collection by leveraging the high-revenue 18% tax slab, while ensuring essential goods remain affordable.

The move also comes at a time where India is facing the threat of additional secondary tariffs of 25% as a result of India’s continued imports of Russian-origin oil, with those tariffs expected to be effective on August 27, bringing the total cumulative tariffs, including reciprocal tariffs, on most Indian exports to the US to 50%.

GST reform, if confirmed, according to a research note from Eastspring Investments, aims to offset some of the negative shock from US tariffs. “The government will reduce the number of GST categories from four to two, with the effect of cutting the overall tax rate,” the note states. “This could add about 0.3% to 0.4% to GDP growth via stronger consumption, partially offsetting some of the roughly 0.6% of GDP drag from the 50% US tariffs.

“The proposed GST simplification should also lower CPI [consumer price index] inflation by about 0.6%, strengthening the case for the Reserve Bank of India to cut rates. We expect India and the US to ultimately reach a trade deal that lowers tariffs. If this materializes, the net effect of the GST simplification should be stimulatory for the India economy.”

Other predicted benefits of such reform involve improved compliance with simplified rates and compliance processes, such as pre-filled returns and compliance ratings, which should reduce errors and disputes, encouraging more businesses to join the GST ecosystem.

“If you look at the current GST regime, it is quite a complex one, with four different rates, which makes accounting and implementation quite difficult,” points out Yee Farn Phua, S&P Global Ratings’ director of sovereign and international public finance ratings. “With the proposed two-rate system, the effective rate could be lower; but, due to easier implementation and clearer accounting processes, this could actually be a boost to fiscal revenues over the longer term.

“We don’t think that the government will reform the GST system to the point that it will hit fiscal revenues. It is possible that, with the lower rates and clearer implementation, it can also help boost consumption spending in the short-term as well.”

The GST Council, led by finance minister Nirmala Sitharaman, is expected to finalize the two-tier structure at its September 2025 meeting, following recommendations from the Group of Ministers, a government executive advisory body. The reforms are slated for rollout around October 20, the time of the Diwali festival.

Despite its promise, the GST 2.0 reform faces hurdles, including revenue risks where the shifting item rate from 28% to 18% could temporarily dent collections, requiring careful calibration to avoid fiscal strain.

In addition, while the proposed two-tier system reduces complexity, ensuring clear categorization of goods and services remains critical to avoiding classification disputes.