Hong Kong dollar savers and depositors who are focused on accumulating wealth through low-risk vehicles like savings accounts and fixed deposits stand to benefit from the Hong Kong Monetary Authority’s ( HKMA ) continuous intervention to defend the HK dollar ( HKD ) to US dollar ( USD ) peg rate.

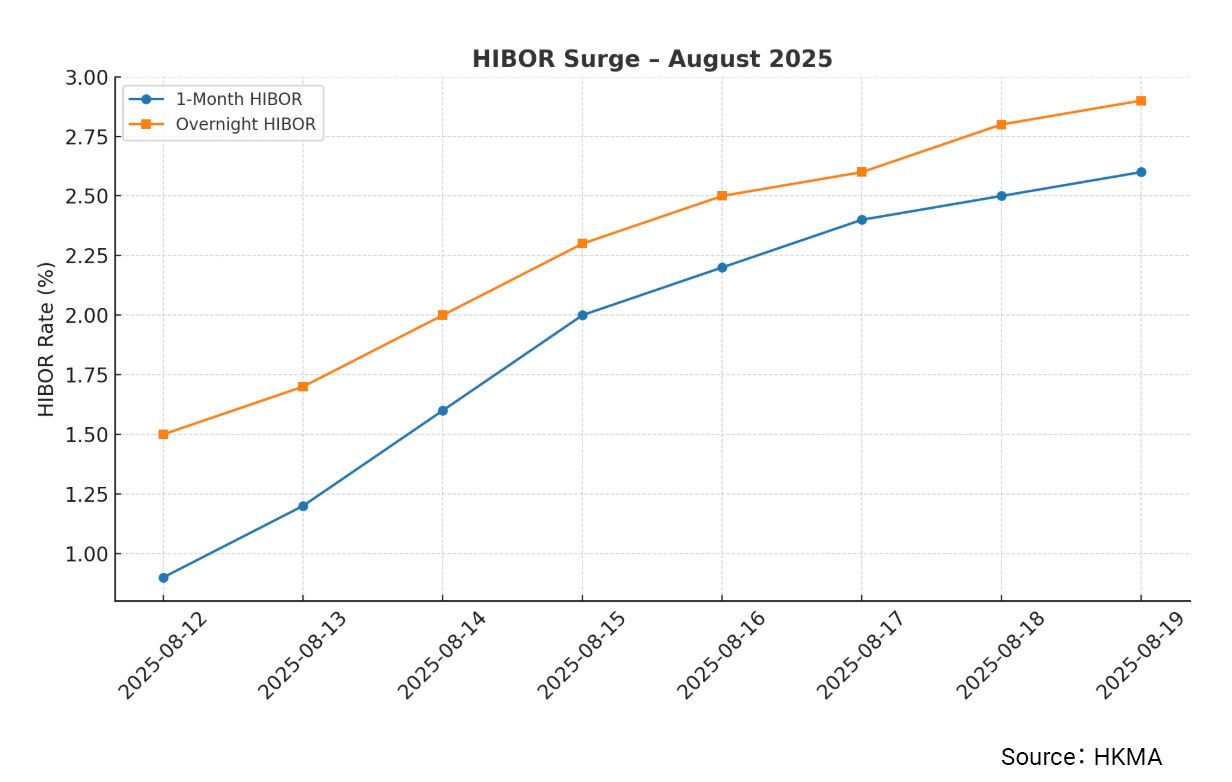

For context, the one-month Hong Kong interbank offered rate ( Hibor ) surged from approximately 0.9% to 2.6% in the past week ( ending Aug 19 2025 ) as result of tightening liquidity in the banking system, driven by the HKMA’s interventions to maintain the HKD-to-USD peg rate ( of HK$7.8 to US$1 ).

Additionally, rates across all tenors rose for the first time since April 2024, with the overnight Hibor rebounding to 2.9%, as of August 19 2025, following a period of volatility earlier in the year.

The HKD is currently under pressure due to a mix of capital inflows strengthening the currency, HKMA interventions to maintain the peg, interest rate arbitrage and global economic volatility. Analysts don’t expect this trend to end in the short-term based on the current market conditions.

The USD/HKD exchange rate has approached the upper limit of its trading band at HK$7.85 multiple times in 2025; and, as a result, the HKMA has stepped up market operations to defend the peg, with multiple interventions.

In August alone, the HKMA, the territory’s de facto central bank, has executed four operations in one week, buying a total of HK$22.326 billion, including specific purchases of HK$8.439 billion ( Aug 6 ), HK$6.429 billion ( Aug 5 ), HK$3.533 billion ( Aug 1 ) and HK$3.925 billion ( July 31 ).

In July, the HKMA intervened at least five times in two weeks, buying HK$72.35 billion and selling US$9.22 billion to combat speculative carry trades.

Before that, in late June 2025, the HKMA purchased approximately HK$9.4 billion ( US$1.2 billion ) after the HKD hit the weak side ( HK$7.85 ) of its trading band, draining liquidity and pushing interbank rates.

In May, the HKMA injected roughly HK$129.4 billion, equivalent to US$16.7 billion, to bolster the peg.

For depositors, who hold HKD funds in savings deposits or time deposits, the rise in Hibor rates presents both opportunities and challenges.

The opportunities can come in the form of potentially higher deposit rates as banks facing elevated borrowing costs are likely to compete more aggressively for deposits, potentially leading to increased interest rates on HKD and USD time deposits and savings accounts.

Rising Hibor rates typically translate to higher savings rates as banks pass on funding pressures. For example, base savings rates – currently near 0.001% to 0.05% per annum ( p.a. ) for major banks like Hang Seng – could edge up, especially for high-balance accounts. Savers in virtual banks or non-bank options ( for example, Syfe Cash+ at 4.15% to 4.35% p.a. for USD ) may see even better promotional boosts.

Promotional rates offered by the banks could also rise, benefiting those rolling over or placing new funds. Current HKD time deposit rates ( for example, 1.5% to 2.3% p.a. for three to 12 months ) and USD rates ( 3.8% to 4.35% p.a. ) might see upward adjustments, especially for short tenors aligned with Hibor movements.

Another opportunity can come in the form of depositors shifting towards higher-yielding USD accounts as the HKMA’s actions reinforcing the HKD peg is effectively minimizing exchange rate risks for USD-linked deposits.

However, there is the challenge that the massive HKMA interventions that have resulted in less cash in the financial system, also referred to as “tighter liquidity”, could make banks more selective in accepting deposits or offering terms, particularly for smaller amounts.

Also, there is the risk of opportunity cost that depositors or savers who are currently locked into longer-term deposits might miss out on potential yield increases if rates continue climbing, though early withdrawal penalties remain a deterrent.

Overall, the net effect is mildly positive for yield-seeking depositors, but those needing quick access to funds might face indirect costs if banks tighten liquidity management.