As global markets navigate the opening weeks of 2026, the era of easy profits from carry trades, borrowing in low-interest currencies to chase higher yields elsewhere, is facing its most significant stress test since the sharp bout of market volatility linked to yen carry unwinding in 2024.

Standard Chartered strategists warned at their 2026 Outlook Media Roundtable that the structural foundations of global liquidity are shifting from central bank support to volatile fiscal spending, creating a “traffic jam” for global debt.

The most acute risk for 2026 remains Japan, which Divya Devesh, co- head of FX research, Asean and South Asia, at Standard Chartered, described as being in an “unstable equilibrium”.

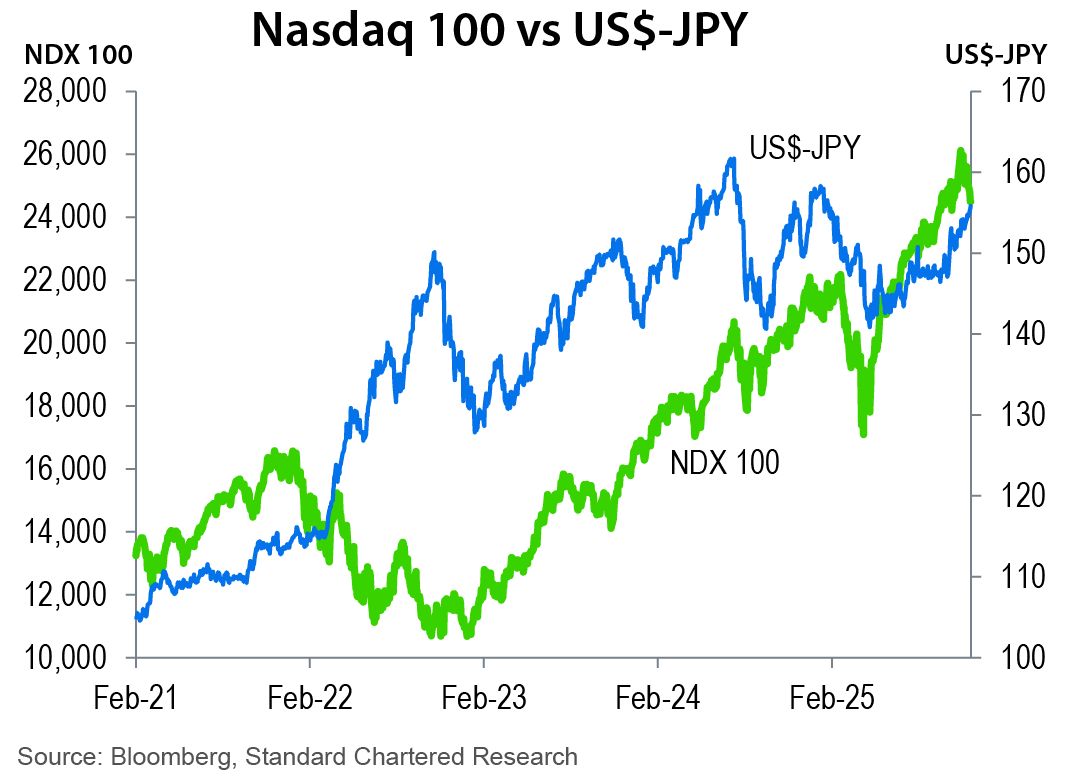

Devesh was referring to the fact that as Japanese bond yields rise, the threat of “repatriation” of capital by Japanese investors is growing, effectively reversing the lucrative carry trade.

Before the rise in Japanese bond yields, the Japanese yen ( JPY ) to US dollar ( USD ) “carry trade” was one of the most popular investment strategies, often described as “picking up pennies in front of a steamroller”.

A carry trade basically involves borrowing money in a currency with a low interest rate ( JPY ) and investing that money in a currency or asset that offers a higher return ( USD ). The profit comes from the interest rate differential, as long as the exchange rate remains stable.

Policy expectations shift

For decades, the JPY was the undisputed king of the carry trade as the Bank of Japan ( BoJ ) maintained “negative” or near-zero interest rates for years to combat deflation.

However, as of January 2026, the Japanese financial landscape has undergone a notable transformation not seen since the market volatility in August 2024, when the gap between Japanese and US rates shifted amid changing BoJ policy expectations and narrowing interest-rate differentials.

The shift in policy expectations, coupled with fears ( at the time ) that the Federal Reserve would cut rates aggressively, triggered a spike in the JPY, which resulted in the reduction of positions and selective unwinding of carry trades.

While the initial crash was a shock to the system, it paved the way for what analysts described as a “new normal” in the Japanese economy, which is the end of “negative” or near-zero interest rates coupled with increased JPY volatility.

Eric Robertson, global head of research and chief strategist of Standard Chartered, says while investors are conditioned to believe that the BoJ will continue to move slowly, any acceleration in Japanese interest rates over time would change the global dynamic.

“Every high-yield market that you look at has some degree of Japanese investment coming into it," Robertson says. “If we were to see a reversal of that, I think that could present a bit of a challenge for some of the emerging markets in the region and the world.”

The current anxiety among investors follows a volatile two-year cycle as investors still recall the yen-driven turbulence of August 2024, when a rapid reassessment of carry trade risk sent shockwaves across global assets.

Cyclical liquidity peak

However, that panic was largely followed by a powerful rebound in liquidity conditions due to an unprecedented wave of monetary easing across the region in 2025, in the wake of what Robertson says was a “perfect storm” of low inflation and falling oil prices.

“In 2025, we had an exceptionally large number of central bank rate cuts,” he explains. “This allowed 2025 to become a cyclical peak for global liquidity, encouraging a massive renewed re-entry into carry trade strategies.”

But Robertson warns that the narrative for 2026 has fundamentally changed as the world moves from monetary to fiscal dominance, with governments now forced to borrow rather than rely on interest rate cuts to support growth.

“If we see sovereigns and corporates around the world all rushing to tap into debt markets over the next six months, I think we potentially have a bit of a traffic jam in terms of global debt issuance,” Robertson warns.

This competition for capital is expected to drive up long-term interest rates, increasing the “funding volatility” that can kill a carry trade.

Devesh also warns that the prevailing market optimism regarding Asian currencies in this environment is “misplaced” – while many investors expected “de-dollarization” to weaken the greenback, “we are actually seeing re-dollarization”.

In fact, he says, the USD has become a high-yielding currency, fundamentally altering how exporters manage money.

“Exporter conversion remains relatively low... it’s easier to hold on to dollars,” Devesh says, noting that even with record trade numbers, currencies like the Taiwan dollar have struggled to perform.